About

Philosophy

Everest believes that adding value starts with identifying strategic opportunities, while combined with creative thought and thorough analysis, with a fundamentals-based approach to value creation. Specifically, Everest’s approach is to anticipate market movements shifting from asset class to asset class, as market conditions warrant.

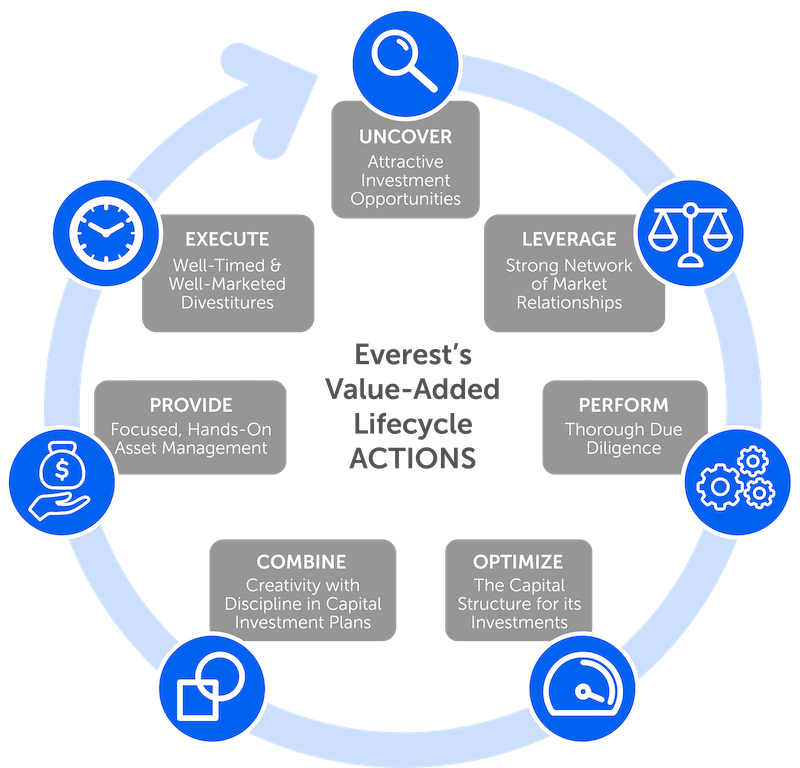

During each phase of the investment lifecycle, Everest uncovers attractive investment opportunities through a strong network of market relationships, performs thorough due diligence, optimizes the capital structure on investments, combines creativity with discipline in its capital investment plans, provides hands-on asset management, and executes well-timed and well-marketed divestitures.

Everest recognizes the cyclical nature of real estate and views it as a commodity with windows to buy, hold, and sell. To begin, we align our interests with our investment partners by placing our own capital at risk on every transaction and receiving returns only when our partners receive theirs.

A successful investment business relies upon the recruitment and retention of outstanding individuals who are engaged, motivated and excited about giving each investment their fullest contribution. Everest employees are among the most talented, experienced and networked in the real estate industry.