Recent Trends

Phoenix Office: The office market continues to strengthen with recent gains in rents, occupancy and absorption. 2014 was the 4th consecutive year of positive net absorption and the most since 2007. Rents at $21-22 remain well below the $26-27 peak range. But they appear to have bottomed with two straight years of increases. Occupancy remains on the upswing as well. But at only 77%, it still has a ways to go before getting back to its 80-90% historical norm.

Phoenix Industrial: The industrial market also continues to improve. Occupancy and rents are at 89% and $0.57, respectively, and trending higher. While occupancy has retraced 50% of its decline from 94% in 2006 to 84% in 2010, rents have surprisingly yet to see much of any meaningful gains and remain at 2004 pre-run up levels.

Market Impact

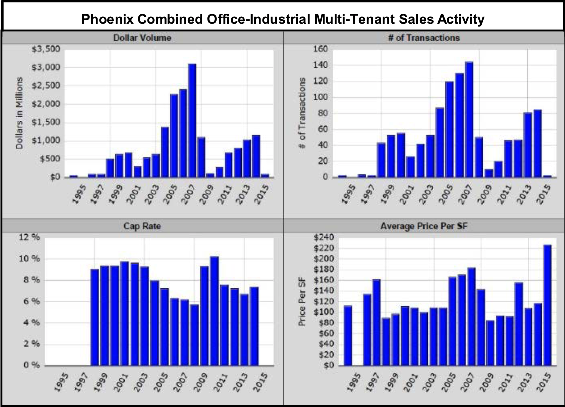

The improved fundamentals of both the office and industrial markets in Phoenix have led to increased investment sales activity. In 2014, the combined Phoenix office and industrial markets saw $1.2 billion of sales activity, which marked the 5th consecutive year of higher volume following the 2009 trough.

At the same time, new supply is picking up. While new office supply has been limited in recent years, that should change in 2015 as the market starts to deliver the first portion of 2-3mm SF of new office supply in the works. Although much of this space is pre-leased, many of these tenants (i.e. State Farm) will be vacating existing buildings, which could have a negative—albeit temporary—impact on certain submarkets (i.e. Airport Area, Tempe). New industrial supply is healthy with 7.1mm SF (2.5% of inventory) delivered in 2014 (most since 2008) and another 3.8mm SF under construction.

Opportunities

Credit tenants continue to seek large blocks of efficient back-office space (75k+ SF) with high parking ratios (6.0+). Given the lack of such space currently available in Phoenix, many developers are fulfilling this demand by delivering new build-to-suits for $15-19 NNN rents on 7-10 year deals. Recent examples include Go Daddy, Wageworks and GM. These rents compare to $10-13 NNN for buildings with lower parking ratios.

Given the large delta in rents, we see an opportunity in acquiring under-parked assets that are otherwise strong and delivering a creative cost-efficient parking solution that tenants and future buyers are willing to pay a premium for.

Everest Insight

Historically, rent movements have lagged occupancy movements by approximately 2 years in Phoenix (both directions). With 4-5 years of strong occupancy gains already behind us and more expected in the near-term, we expect office and industrial rent growth to accelerate in 2015 and remain strong through 2017 to 2019 at least.